Describe the differences between a regressive and progressive tax. Provide some examples of each in Canada. – Intermediate Canadian Tax – ACCT 3335 – Fall 2021

taxes - How to calculate after-tax return if investor can use capital loss, in Canada? - Personal Finance & Money Stack Exchange

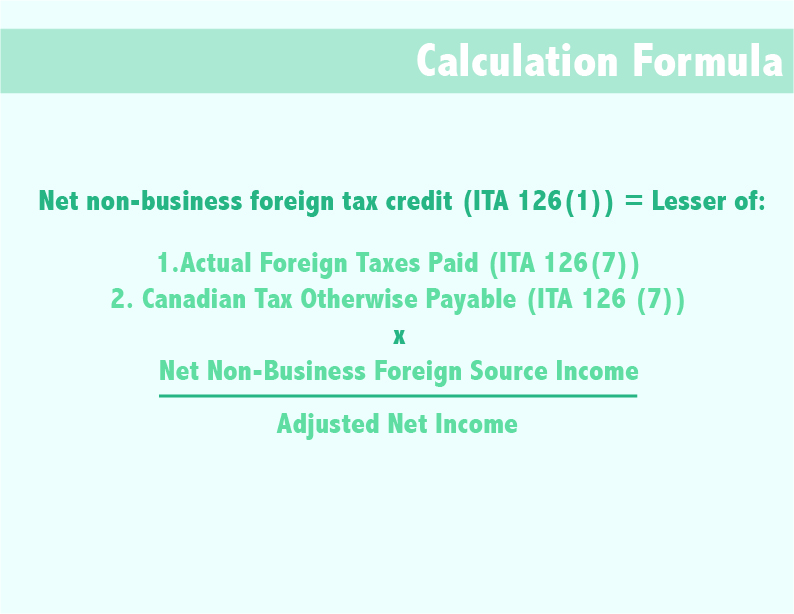

Canadian residents who own U.S. assets may need to pay U.S. estate tax | Manulife Investment Management

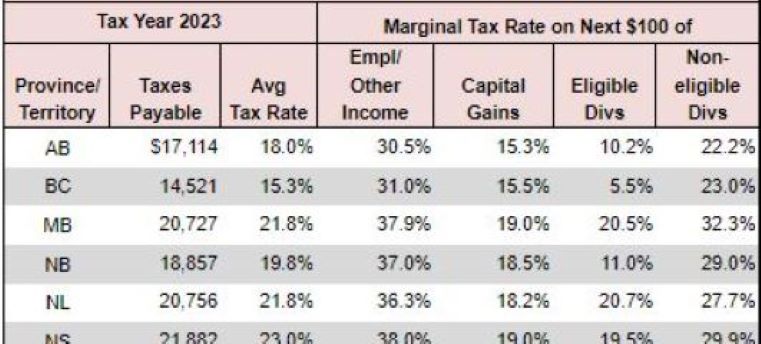

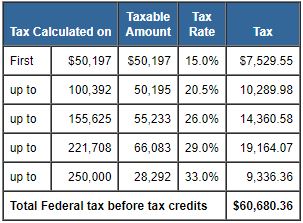

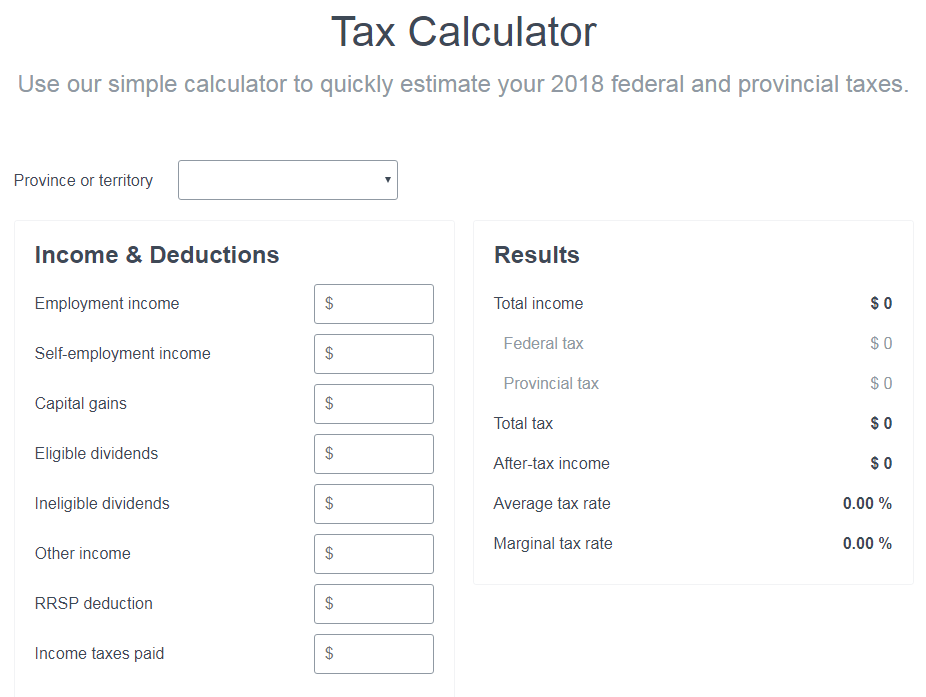

Nat Miletic on X: "If you live in Canada, this is how much tax you would pay as an employee earning $250K https://t.co/e2RG9AgIO9" / X

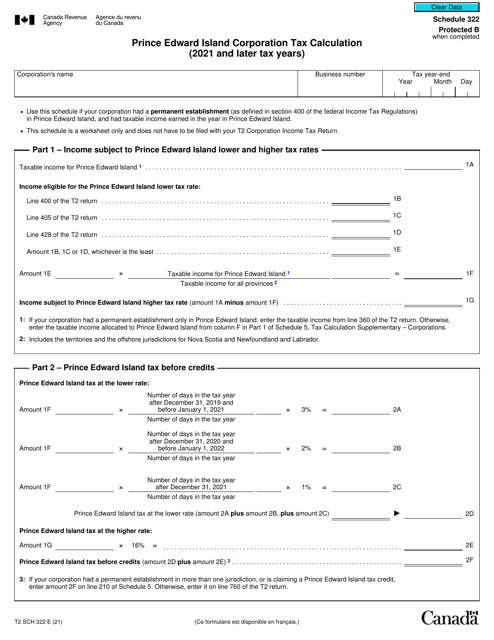

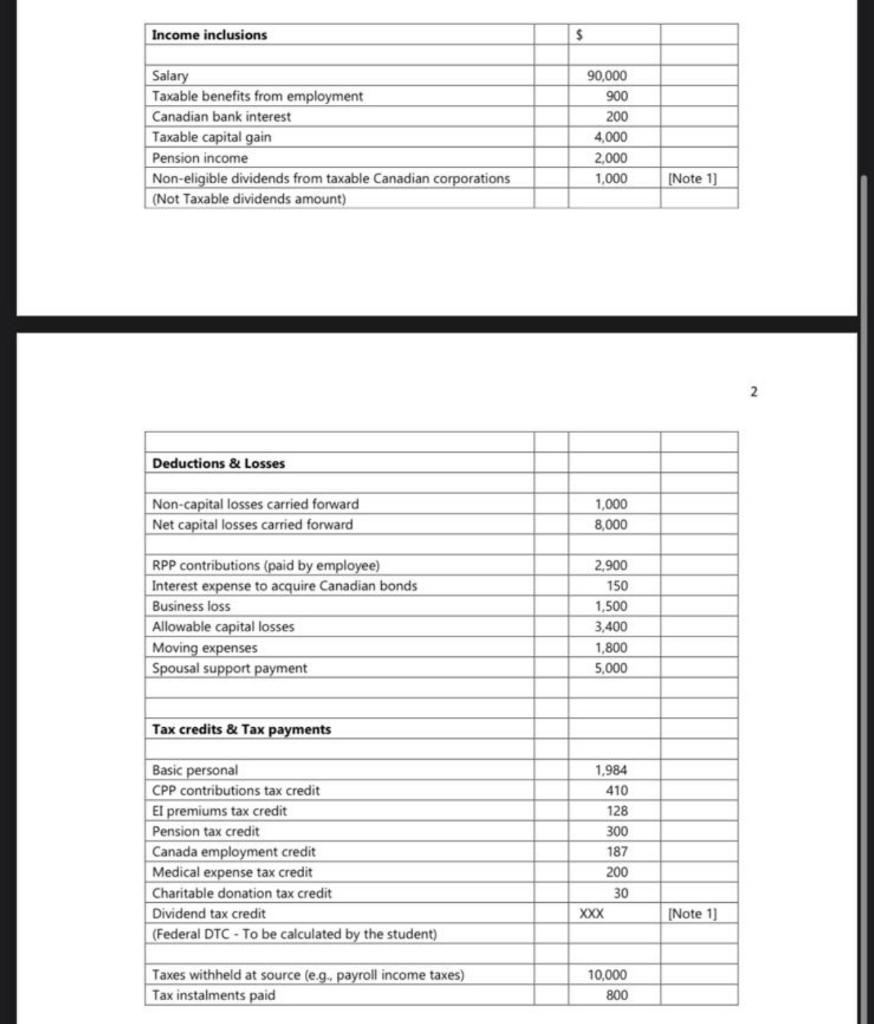

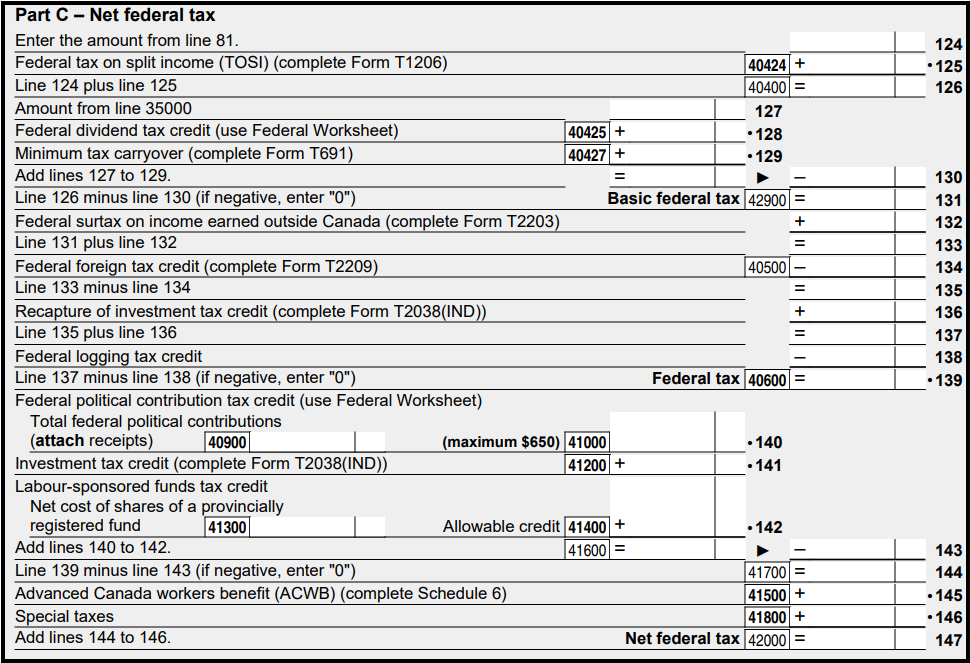

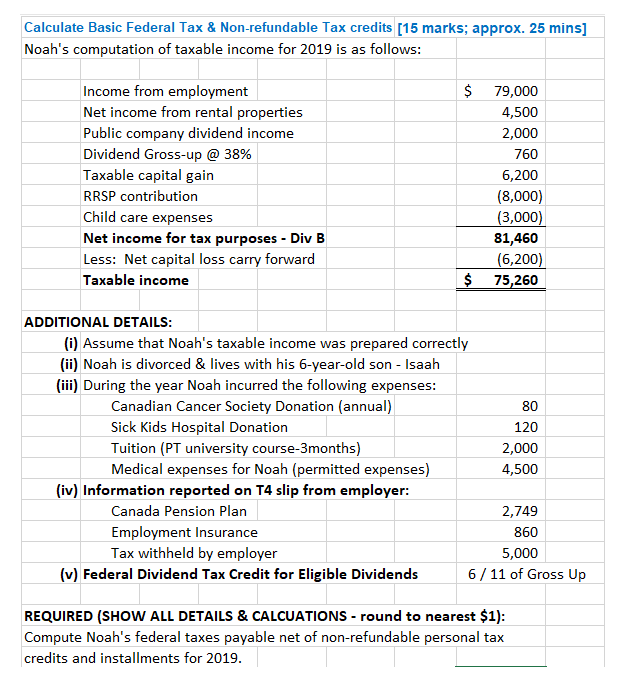

How do you get from Net Income for Tax Purposes to Taxable Income to Tax Payable? – Intermediate Canadian Tax

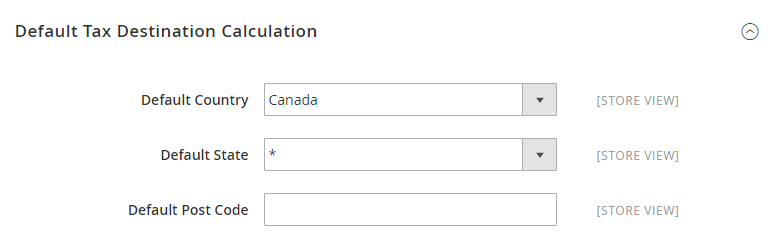

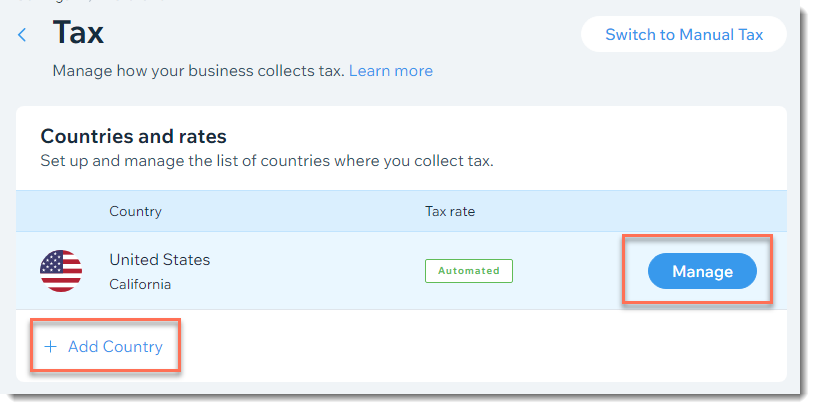

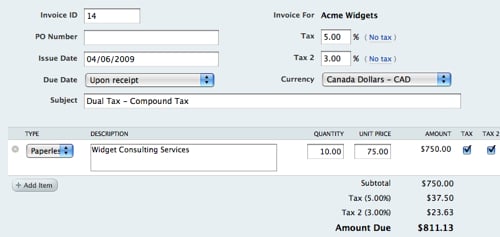

How US External Tax tackle Cross-Border Transactions between US and Canada in S/4HANA Cloud 1911 | SAP Blogs

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)